Even if multi-millionaires simply pay what they owe, they will still not be paying what they should. (And, as I noted in yesterday’s post, multi-millionaires are the biggest tax evaders and the least likely to be audited.) Deductions, exemptions, lower tax rates on capital gains, tax shelters available only to those with a lot of money: these all combine to reduce the amount of income on which taxes are paid. But that’s not all: low marginal tax rates and inequitable rules on social security contributions are big factors in lowering taxes for high-income earners. This happens in two ways:

First, the highest-income earners do not have to pay Social Security and Medicare taxes on most of their income.

Second, the marginal tax rate on the highest incomes has been slashed over the past 80 years.

Besides these problems with individual taxes, large, profitable corporations got a massive tax break in the Trump years and still managed to keep the loopholes that help many avoid paying any taxes.

The Social Security problem

Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $160,200 (in 2023). Self-employed people pay 12.4 percent. Add to that the Medicare tax of 1.45 percent on employees and 1.45 percent on employers, and 2.9 percent for self-employed individuals. That’s a combined payroll tax of 15.3 percent on the first $160,200 of earnings.

This starts out as a flat tax: if you earn $5,000, you pay 15.3 percent in Social Security and Medicare taxes. If you earn $100,000, you pay the same 15.3 percent. That’s in addition to any income taxes that you pay.

But when you earn more than $160,200, then you pay less. Actually, it’s even worse than that. The income tax rate applies only to “taxable income,” which is income after subtracting deductions and exemptions. Social Security and Medicare tax applies to every single dollar you earn in wages or self-employment income.

You may have heard the refrain that “Social Security is going broke.” I started hearing that when I was in 8th grade, about 50 years ago, so I’m not entirely convinced that it is true. But even if it is true, there’s an easy solution: just make the highest earners keep on paying Social Security and Medicare taxes, instead of giving them a pass after they hit the $160,200 earning mark. That would make Social Security and Medicare solvent forever.

The Maximum Tax Rate is Too Low

This gets a little complicated, but it’s worth the effort to understand.

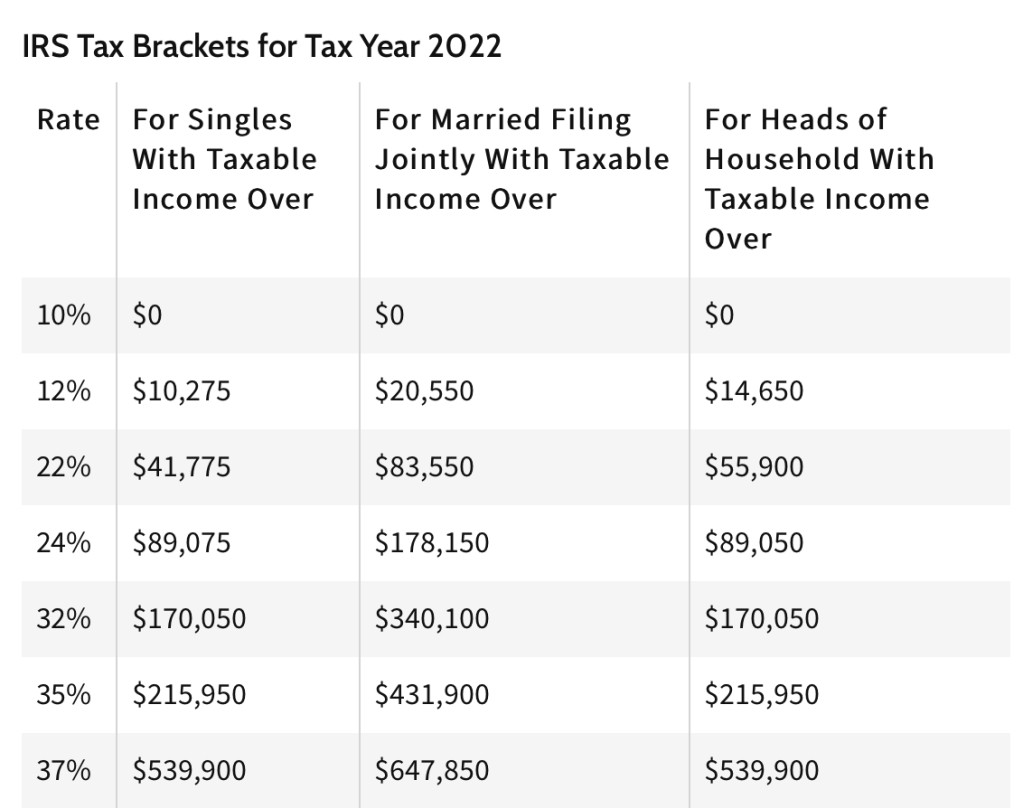

The marginal tax rate is the rate paid on different levels of taxable income. That’s income after all deductions and exemptions—and remember that those deductions and exemptions already drastically reduce the amount of income that counts as taxable income for the highest earners. Here’s the table showing current marginal tax rates:

(For a more detailed explanation of tax rates, tax brackets, effective and marginal tax rates, etc., see Investopedia’s excellent article on marginal tax rates.)

Here’s how marginal tax rates work. A single taxpayer with a taxable income of $50,000 in 2022 would pay:

• 10 percent of the $10,275 in taxable income that falls in the lowest tax bracket. That’s $1,027.50.

• 12 percent of the $31,500 in taxable income that falls in the next tax bracket. That’s $3,780.

• 22 percent of the $8,225 that falls in the next tax bracket. That’s $1,809.50.

Now, what happens if someone has a taxable income of a million dollars? Like the taxpayer with $50,000 in taxable income, the million-dollar earner still pays 10 percent on the first $10,275 of taxable income, 12 percent of income between $10,275 and $41,775, and 22 percent of income between $41,775 and $89,075.

The tax brackets keep on going up to the highest: 37 percent of taxable income in excess of $539,900 for a single taxpayer with no dependents.

Is 37 percent a high tax rate? No. Historically, that’s a low marginal tax rate. Back in 1940, the highest marginal tax rate was 81 percent. During World War II, that increased to 94 percent. In the Republican years of the Eisenhower presidency, the highest marginal tax rate remained at 91 percent. In the mid-1960s the tax rate on the wealthiest U.S. taxpayers started going down, bottoming out at 28 percent in 1988. (For the complete history, see this table from the Tax Policy Center.)

Remember: Nobody pays an income tax rate of 37 percent on their income. The highest rate is ONLY paid on (1) that income that is considered “taxable income” AND (2) the portion of taxable income that is in excess of $539,900 for a single taxpayer with no dependents.

Pro Publica analyzed how much—or how little—the 25 wealthiest taxpayers in the United States pay:

“On average, they paid 15.8% in personal federal income taxes between 2014 and 2018. They had $86 billion in adjusted gross income and paid $13.6 billion in income taxes in that period.

“That’s lower than the rate a single worker making $45,000 a year might pay if you include Medicare and Social Security taxes.”

And that’s why I think the highest marginal tax rate should be MUCH higher than 37 percent.

Corporations Evading Taxes

And then there’s the corporate income tax. Corporations pay a flat rate of 21 percent on their profits. Remember—only on their profits. That means they can deduct every penny of million-dollar executive salaries and every penny of their “doing business” expenses, depreciation, etc. from their income before reporting the taxable profits.

The 21 percent rate went into effect with the Trump tax cuts of 2017. Before that, corporations paid tax on profits at an official rate of 35 percent.

But wait—that’s only the official tax rate. Corporate tax loopholes mean the actual rate is much lower. Investopedia reports:

“The difference between the 21% statutory corporate income tax rate and the effective rate based on the cash taxes companies actually pay is the result of generous tax breaks doled out by U.S. Congress.

“The 379 profitable Fortune 500 companies paid an average effective federal income tax rate of 11.3% on their 2018 income.”

In fact, the U.S. Government Accountability Office found that many large and profitable corporations pay no income taxes.

“In each year from 2014 to 2018, about half of all large corporations had no federal income tax liability. For the purposes of this report, GAO considers “large corporations” to be those that filed Internal Revenue Service (IRS) Schedule M-3. This form is required for corporations with $10 million or more in assets. Among profitable large corporations, on average, 25 percent had no tax liability.“

The Institute on Taxation and Economic Policy got specific, detailing 55 large, profitable corporations that paid no income tax in 2020:

“The companies avoiding income taxes in 2020 represent very different sectors of the U.S. economy:

“Food conglomerate Archer Daniels Midland enjoyed $438 million of U.S. pretax income last year and received a federal tax rebate of $164 million.

“The delivery giant FedEx zeroed out its federal income tax on $1.2 billion of U.S. pretax income in 2020 and received a rebate of $230 million.

“The shoe manufacturer Nike didn’t pay a dime of federal income tax on almost $2.9 billion of U.S. pretax income last year, instead enjoying a $109 million tax rebate.

“The cable TV provider Dish Network paid no federal income taxes on $2.5 billion of U.S. income in 2020.

“The software company Salesforce avoided all federal income taxes on $2.6 billion of U.S. income.”

Solutions

Four simple steps could go a long way toward funding what we need to do as a nation, from sustainable energy to infrastructure to education to universal health care. Those four steps:

1) Fund the IRS to go after high-income tax cheats.

2) Increase the marginal tax rate for the highest earners. How much? Just for the sake of argument, how about midway between today’s 37 percent and the Eisenhower-era 91 percent? That would set the highest marginal tax bracket at 64 percent.

3) Remove the cap on Social Security and Medicare taxes so that the wealthiest earners keep on paying these.

4) Make corporations pay their fair share.

For more, see

Making Millionaires Pay Their Fair Share: Part I

and

Making Millionaires Pay Their Fair Share: October 2023 Update

Discover more from News Day

Subscribe to get the latest posts sent to your email.